Businesses in the tourism sector are optimistic about the third quarter of 2022 after the end of the off-peak season from May to July, according to the central bank’s Quarterly Business Survey.

Top management of tourism business who responded to the survey expected total revenue and resort bookings to rise in Q3-2022.

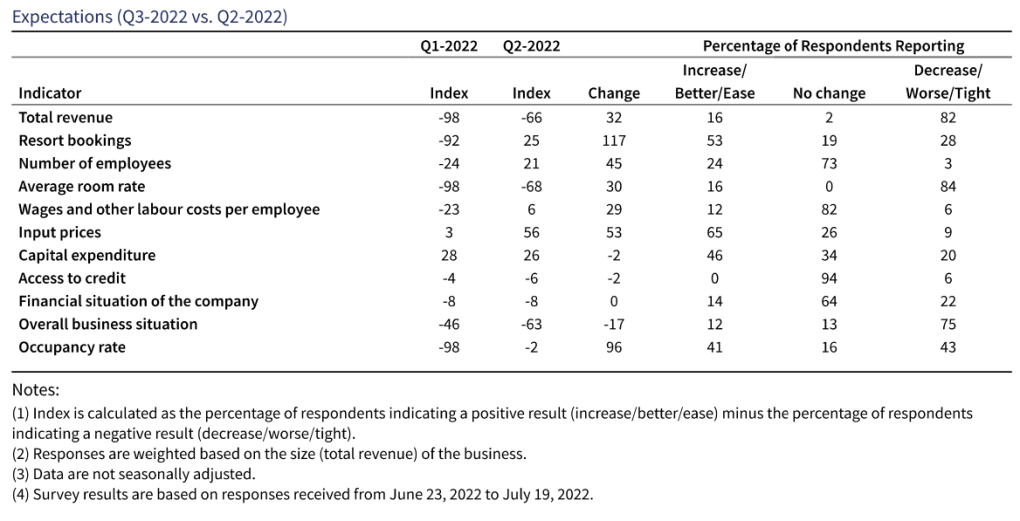

“In line with these developments, the expected average room rate index improved to -68 from -98, with 84 percent of businesses expecting average room rates to decrease in Q3-2022 and 16 businesses expecting average room rates to increase. The expected indices for input prices, employment and wages and other labour costs are anticipated to increase in Q3-2022,” the report explained.

“Both the expected indices for the financial situation of the company and the overall business situation remained negative in Q2-2022, while the overall business situation is expected to further worsen, albeit moderately (from -46 to -63).”

The central bank carries out the quarterly survey for a quick assessment of trends and expectations for future economic activity. The respondents include managers of tourist establishments and the questions “cover the views of the senior management (for the past quarter and expectation for the next quarter) on the direction of change in various business variables such as sales, output, prices, capacity utilisation and employment which are useful for analysing and predicting economic activity. The qualitative response for these questions takes the form of either increase, decrease or no change.”

The second quarter survey was carried out from 23 June to 19 July 2022 with electronic survey forms sent to 195 enterprises in the tourism, construction, wholesale and retail trade, and transport and communication sectors. The overall response rate was 71%.

“The qualitative responses to the survey are converted to quantitative numbers by subtracting the percentage of respondents reporting an increase from the percentage of respondents reporting a decrease. All responses are weighted based on their relative size (using revenue) within their respective sector,” according to the central bank.

Reflecting the off-season where the lowest tourist arrivals are recorded, the indices for total revenue, resort bookings and employment fell sharply in the second quarter. But since the responses from tourism businesses are not seasonally adjusted, the central bank cautioned that “care should be taken when interpreting quarterly changes as this would reflect effects of both the underlying changes and seasonal effects.”